8 Ergebnisse

This multimedia dossier is part of the series „Understanding Finance“ by Finance Watch and explores the following questions: What is bank capital and how is it regulated? It further presents controversies on the size of bank capital in the aftermath of the financial crisis and on how bank capital affects economic activity.

This multimedia dossier is part of the series „Understanding Finance“ by Finance Watch and presents a description and critical review of financial markets and their functions. It furthermore discusses recent developments, as high frequency trading.

This multimedia dossier is part of the series „Understanding Finance“ by Finance Watch. The dossier focuses on universal banks – banks that pursue commercial and investment banking and points out several problems of those megabanks, especially in the context of the financial crisis (too big to fail).

Most mainstream neoclassical economists completely failed to anticipate the crisis which broke in 2007 and 2008. There is however a long tradition of economic analysis which emphasises how growth in a capitalist economy leads to an accumulation of tensions and results in periodic crises. This paper first reviews the work of Karl Marx who was one of the first writers to incorporate an analysis of periodic crisis in his analysis of capitalist accumulation. The paper then considers the approach of various subsequent Marxian writers, most of whom locate periodic cyclical crises within the framework of longer-term phases of capitalist development, the most recent of which is generally seen as having begun in the 1980s. The paper also looks at the analyses of Thorstein Veblen and Wesley Claire Mitchell, two US institutionalist economists who stressed the role of finance and its contribution to generating periodic crises, and the Italian Circuitist writers who stress the problematic challenge of ensuring that bank advances to productive enterprises can successfully be repaid.

Andrea Binder ist Expertin für Offshore Finanzen und humanitäre Politik. In ihrer kürzlich ausgezeichneten Dissertation hat sie sich damit beschäftigt, wie G...

Der Beitrag befasst sich mit der Schaffung finanztheoretischer Rahmenbedingungen hinsichtlich einer sozial-ökologischen Transformation der heutigen Wirtschaftsweise durch gezielt-effiziente Anpassung der Geschäftstätigkeit des globalen Bankensektors unter Betrachtung der resultierenden Folgewirkungen zwecks hinreichender Zielerfüllung im Sinne des Pariser Abkommens.

Wie erfüllen und finanzieren wir die Ziele des Pariser Abkommen / Climate Agreement (Social Development Goals (SDG) & Environmental Social Governance (ESG)) in nur noch 30 Jahren? Eine mögliche Antwort.

Asset Management firms control large parts of the global economy Just the three American asset management firms BlackRock Vanguard and State Street manage more than half of the combined value of all shares for companies in the S P 500 Their combined managed assets amount to 22 trillion May 2022 …

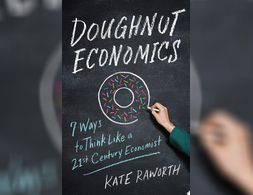

That’s why it is time, says renegade economist Kate Raworth, to revise our economic thinking for the 21st century. In Doughnut Economics, she sets out seven key ways to fundamentally reframe our understanding of what economics is and does.

Wir nutzen Cookies. Klicke auf "Akzeptieren" um uns dabei zu helfen, Exploring Economics immer besser zu machen!